Gone are the days of renting expensive office space just so you can have a business address. In today’s digital age, it’s not only possible to use a virtual address for LLC registration, it’s highly recommended for both efficiency and cost savings. By comparing different providers, you can find the best virtual address services that cater to your specific needs and locations.

Let’s explore the world of virtual addresses, a cost-effective solution for businesses looking to maintain a professional image and protect their privacy.

I’m going to guide you through the process of understanding virtual addresses for LLCs, choosing the right provider, registering your virtual address for LLC, and maintaining compliance while reaping the benefits of flexibility and scalability.

Short Summary

Use the navigation below to jump to a specific section of this article:

- Understanding Virtual Addresses for LLCs

- Choosing the Right Virtual Address Service

- Registering Your LLC with a Virtual Address

- Virtual Address vs. Registered Agent Address

- Legal Requirements & Restrictions for Virtual Addresses

- Benefits of a Virtual Address for an LLC

- Opening a Bank Account with your Virtual Address

- Maintaining Compliance

- Frequently Asked Questions

To start, let’s take a moment to understand how a virtual mailbox works for a business LLC.

Introduction to Virtual Addresses

A virtual address is a physical address that can be used as a business address, providing a professional image and separating personal and business mail.

For small business owners, this is a cost-effective solution to establish a presence without the need to rent physical office space. Virtual addresses can be utilized for various purposes, including receiving business mail, packages, and legal documents. By using a virtual address, businesses can maintain a professional image, increase privacy, and build credibility.

This is particularly beneficial for small businesses and entrepreneurs who want to project a polished and professional appearance without the overhead costs associated with a physical office.

Understanding Virtual Addresses for LLCs

A virtual business address is a physical address provided by a virtual mailbox service that allows you to receive postal mail without the need for a traditional office space.

When it comes to a virtual address for your business, your LLC can maintain a professional appearance, protect your home address from being public record, and comply with the legal requirements for a business entity. Using a business mailing address is crucial for protecting personal privacy and meeting state registration requirements.

Virtual address services offer a real street address, usually a company-owned or independent mail center. This means that a virtual address can be used as your registered agent address, which can enhance your business presence and make it easier for customers to find you.

One of the main advantages of using a virtual address for your LLC is the ability to receive postal mail without the need to disclose your home address. This added level of privacy is important for freelancers, small business owners and even remote workers.

Virtual addresses also allow businesses with multiple locations to consolidate all their business mail in one central location.

Moreover, virtual address services often come with additional features such as mail forwarding, digital mailroom services, check deposit and registered agent services, making them a comprehensive solution for business needs.

Business Entity and Virtual Address

A business entity, such as a limited liability company (LLC), can use a virtual address as its official business address. This provides a physical street address where mail and packages can be received, and it can be used for business registration and licensing purposes.

Additionally, a virtual address can serve as a registered agent address, offering a secure and reliable way to receive important documents and notices. By using a virtual address, businesses can effectively separate their personal and business assets, protecting their personal assets from business liabilities. This separation is crucial for maintaining the integrity and professionalism of the business while ensuring compliance with legal requirements.

Choosing the Right Virtual Address Service

To choose the right virtual address service for your LLC, you should consider a number of different factors such as:

- Location (which state is your business registered in?)

- Volume of mail (how many scans do you need per month?)

- Additional services & features (i.e. check deposit? multiple recipients?)

- Independent address vs primary hub

For most LLCs, it’s wise to opt for an address close to where you primarily do business to make it easy to collect your business mail and showcase your proximity to customers.

Another important factor to consider is the monthly fee associated with the virtual address service. The monthly fee can vary based on location and included services, so it’s essential to compare different plans and understand any additional costs for extra features.

Some virtual address providers, like iPostal1, offer virtual office addresses, which include a a business phone and fax number. Remember to compare different virtual address providers and evaluate customer reviews and testimonials to make the most informed decision for your LLC.

Comparing Virtual Address Providers

What exactly are we looking for when evaluating various virtual address providers as the suitable options for your LLC’s requirements. Different providers offer a range of services, including

- Mail Pickup Options: Would you like to be able to personally go pick up the mail instead of having it forwarded to you? Not every virtual address allows for this, and some of them charge an extra fee, so be sure to check carefully.

- Mail scanning: Every virtual mailbox service offers mail scanning, but how they count a “scan” and an “open” varies wildly. You need to determine how much mail you expect to receive each month and look at the different plans that would meet that need.

- Registered agent services: While most any virtual address can be used as a registered address for your LLC, not every mailbox company offers dedicated registered agent services. It’s usually an added cost, and often unnecessary, but if it’s important to you, keep an eye out for it.

- Mail forwarding: Some addresses only forward documents and some only mail domestically. If you think you’ll need to forward packages or to send items internationally, this is important to check.

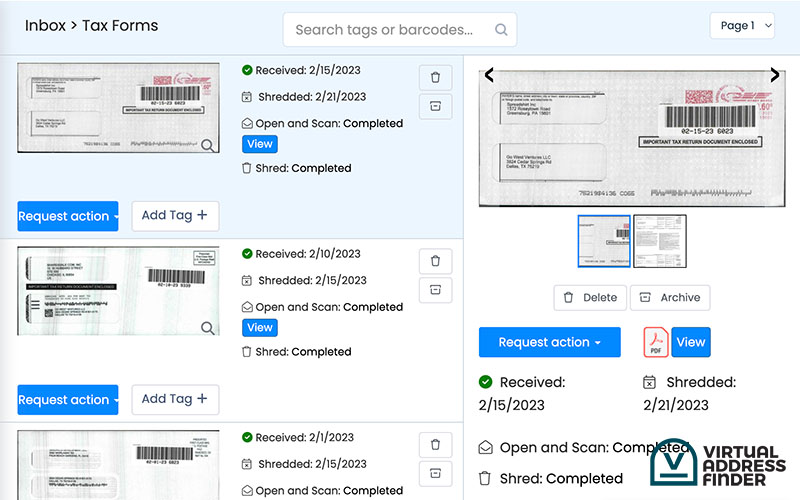

- Digital mailbox options: The ability to organize your digital mail using a handy dashboard is a staple of virtual mailboxes, but as with any software, some dashboards are better than others.

- Online portal: An online portal is crucial for managing your mail remotely. It allows businesses to access and handle their postal mail efficiently and securely without a physical presence, which is particularly beneficial for businesses operating online.

By comparing different virtual address providers on these feature sets, you can ensure that you select the best fit for your LLC’s needs.

Evaluating Customer Reviews and Testimonials

Taking customer feedback into account when selecting a virtual address service can provide valuable insight into the quality and dependability of the provider. The biggest problem, though, is finding unbiased reviews.

We do our best on Virtual Address Finder to write out detailed virtual mailbox reviews that are not only based on our experience using the software, but in many cases even visiting the addresses in person.

Even if you prefer a review site like TrustPilot, analyzing customer reviews and testimonials can help you make a more informed decision and select a virtual address service that best meets your LLC’s needs and expectations.

Registering Your LLC with a Virtual Address

To register an LLC with a virtual address, you need to follow these steps:

- Engage a virtual address provider.

- Execute the necessary steps to form an LLC in the applicable state.

- File Form 1583 with USPS to authorize mail reception at your virtual address.

- Update your business entity documents with the new virtual address.

By following these steps, you can successfully register an LLC with a virtual address, which can serve as a legitimate commercial address for your business. It’s crucial to understand the difference between a physical business address, which is the physical location of your business, and a registered agent address.

Your physical address is the place of operation for your business, while your registered address is the official address for receiving legal and tax documents.

By registering your LLC with a virtual address, you can maintain a professional image and protect your personal assets.irtual address, you can maintain a professional image and protect your personal assets.

Filing Form 1583 with USPS

Form 1583 is a document that authorizes a virtual address to accept mail on you or your businesses behalf and is required for LLC registration with a virtual address. The process for filing Form 1583 with USPS requires the submission of two forms of identification and authorizing the virtual address provider to act as the LLC’s agent for the receipt of mail.

Often, your mailbox company will help you through this process.

By submitting Form 1583, you ensure that your LLC is properly registered and that mail reception at your virtual address is authorized, complying with all legal requirements.

Updating Business Entity Documents

Ensuring that all legal documents and correspondence are received at the correct address is critical when using a virtual address for your LLC. The point of a registered address is so that the state can know that they always have a place to communicate with you.

If you’re using a virtual address as your official LLC address, it’s recommended to update the business entity documents with the appropriate state office by submitting an amendment form on the secretary of state’s website.

In most states, a virtual office address is permissible to use as an official legal address for an LLC, ensuring a professional image and compliance with legal requirements.

Virtual Address vs. Personal Address

Using a virtual address instead of a personal address can provide several benefits for small business owners.

- A virtual address helps maintain a professional image, increases privacy, and builds credibility.

- It also offers a secure and reliable way to receive mail and packages, reducing the risk of lost or stolen items.

- Furthermore, a virtual address can be used to register a business, obtain licenses and permits, and open a business bank account.

By using a virtual address, business owners can keep their personal address private and separate from their business activities, ensuring a clear distinction between personal and professional life.

Virtual Address vs. Registered Agent Address

A virtual address is used for receiving incoming mail and creating a business presence, while a registered agent address is employed to receive service of process for an LLC or corporation.

- A virtual address provides a consistent office address and ensures important mail is not missed;

- A registered agent address is a legal requirement for businesses within a state to properly receive official state documents and notices.

It’s important to understand the distinction between a virtual address and a registered agent address when forming an LLC. While a virtual address offers the flexibility of receiving mail and establishing a business presence, a registered agent address fulfills the legal requirements for receiving official documents, such as tax notices and lawsuits, on behalf of your LLC.

They can be one in the same, but they don’t have to be.

You can choose to be your own registered agent, but this comes with implications such as the public disclosure of your home address and the risk of missing important legal communications if you are not always available.

Both virtual and registered agent addresses contribute to the professional image of your business while safeguarding your personal assets.

Legal Requirements and Restrictions for Virtual Addresses

The legal requirements and restrictions related to the use of a virtual address for an LLC may differ depending on the state, and should be investigated prior to use

In general, virtual addresses can be used for LLCs as an official business address, but it’s crucial to adhere to all legal requirements to operate a virtual office company in the applicable state and city.

Some examples of legal requirements and restrictions associated with using a virtual address for an LLC include:

- Filing Form 1583 with the USPS;

- Updating business entity documents, and

- Ensuring compliance of the virtual mailbox company.

By adhering to state and federal regulations, you can guarantee that your LLC is operating in a legitimate and compliant manner while protecting your personal assets from potential legal issues.pliant manner while protecting your personal assets from potential legal issues.

Benefits of a Virtual Address for Your LLC

Using a virtual address for your LLC offers numerous advantages, including confidentiality, easy mail management and a professional appearance. It allows businesses of every size to receive mail to their virtual address and handle it from any location, providing convenience and ease of access.

Virtual address services also manage physical mail, allowing users to receive email notifications, review their mail online, and choose how to handle physical mail and packages, including options for scanning, forwarding, or shredding.

Additionally, virtual business addresses offer businesses the capability to swiftly and conveniently scale their operations, growing with your business.

Mail Forwarding and Digital Mailroom Services

Organizing mail using on a digital dashboard is a game changer for most businesses. It’s easy to manage mail and keep a digital record. Anytime Mailbox is a practical and cost-effective solution for businesses seeking to establish a professional address without using a home address. They offer features like mail scanning and forwarding, enhancing remote mail management.

Virtual business mailbox services, such as those offered by PostScan Mail, provide permanent virtual addresses and mailboxes with features such as:

- Digitized mail;

- Enhanced location security;

- Encrypted digital storage;

- Safe scanning;

- Quick and easy forwarding;

- Mail shredding;

- Check deposits from any location globally.

These services offer convenience and security, ensuring that your important business mail is always accessible and well-managed.

Flexibility and Scalability

Virtual addresses provide businesses with the following benefits:

- Flexibility to easily expand or relocate without updating business entity documents or filing paperwork with the USPS

- Simplified process of expanding or relocating your business;

- Ability to focus on your business, not on your mail;

- Utilize multiple virtual addresses to enhance your presence in various locations and target diverse markets, providing flexibility for establishing a professional image in different areas;

Furthermore, workplace flexibility enables businesses to:

- Adapt their operations to meet customer requirements

- Scale up or down as necessary

- Facilitate cost savings

- Improve productivity

With a virtual address, your LLC can enjoy the benefits of flexibility and scalability, making it an invaluable asset for your business.

Establishing a Business Presence

A virtual address can be used to establish a business presence in a specific location, such as a city or state. This can be particularly beneficial for businesses looking to expand their operations or enter new markets. By using a virtual address, businesses can create a professional image and build credibility with customers and partners.

Additionally, a virtual address allows businesses to receive mail and packages efficiently, providing a convenient way to manage business operations. With the flexibility of a virtual address, businesses can establish a presence in multiple locations, increasing their reach and visibility, and ultimately enhancing their market presence.

Opening a Business Bank Account with a Virtual Address

A virtual address is a legitimate physical address that can be employed to open a business bank account as long as that address is listed on your official business documents.

Depending on the business model, companies might not require physical access to their mail, making virtual address services an ideal solution. Different business models can influence the choice of virtual address services based on their operational needs and the advantages of digital solutions tailored to various business scenarios.

The requirements for opening a business bank account with a virtual address may differ depending on the bank, so it’s essential to contact the bank directly to obtain a comprehensive list of documents accepted for proof of address.

Having a separate business bank account not only helps maintain a professional image, but also simplifies your bookkeeping and tax management processes.

Maintaining Compliance with a Virtual Address

Compliance with a virtual address refers to the legal requirements for using a virtual address as the registered address for an LLC. Ensuring that your LLC is meeting all relevant laws and regulations is essential to safeguard it from potential legal issues and verify that it is operating in a legitimate and compliant manner.

Establishing a credible physical address is crucial for how a business operates, as it significantly impacts customer perception and trust. While a virtual address can enhance business legitimacy, it is not a legal requirement but can be beneficial when moving or expanding into new locations.

Establishing business credit is crucial for small businesses, as it allows for the separation of the business’s credit history from the personal credit history of the business owner. This protects the personal credit score of the business owner and provides access to better loan terms and more favorable repayment terms.

Maintaining a positive credit history with financial institutions can further enhance your loan terms, reduce interest rates, and increase the likelihood of loan approval.

By maintaining compliance with a virtual address, you ensure that your LLC is operating within the bounds of the law and can continue to grow and succeed.

Summary

In conclusion, virtual addresses offer a cost-effective solution for businesses looking to manage their mail, enhance their professional image and protect their privacy. With the right virtual address service, you can ensure that your LLC is properly registered and compliant with state and federal regulations. From choosing the right provider to opening a business bank account and maintaining compliance, a virtual address is an invaluable asset for your LLC.

Embrace the flexibility and scalability offered by virtual addresses and watch your business grow and succeed. By taking advantage of mail forwarding and digital mailroom services, you can stay connected to your business no matter where you are. So, go ahead and explore the world of virtual addresses – your LLC will thank you.

Frequently Asked Questions

As you can imagine, I receive numerous questions from small businesses about using a virtual address to set up their LLC. Here are answers to the most common questions:

The IRS does accept virtual office addresses when obtaining an EIN. This means you can use your virtual office address for all correspondence from the IRS, as well as for filing tax forms or other LLC-related documents. By using your virtual address, you can ensure that you don’t miss any important documents from the IRS.

It is important to note that the IRS will only accept virtual addresses that are valid and up-to-date.

The best address for an LLC is one that meets the requirements for legal registration and offers privacy from your personal address. You may need to purchase a virtual business address, lease an office space, or use the address of your registered agent to meet these needs.

Yes, you can use a virtual address to register your LLC in North Carolina. However, you must check with the state for specific requirements before doing so.

Yes, a virtual address can be used when registering an LLC in Tennessee. It’s a great way to keep your home address private while still complying with the state’s legal requirements.

A virtual address is a physical address provided by a service that allows you to receive mail without the need for a traditional office space. It’s beneficial for LLC registration, as it projects a professional image and protects your privacy.

Jared has been living the “digital nomad” lifestyle for more than 5 years, hopping around different countries throughout Asia. He uses a virtual address for all mail while he travels that he uses for his freelance work as well as his personal address while he’s away from his home country.